We invite you to read about news, developments and other items of interest concerning tax and accounting matters.

News

Savings bonds are purchased by many Americans, often as a way to help fund college or show their patriotism. Series EE bonds, which replaced Series E bonds, were first issued... Read More

Divorce entails difficult personal issues, and taxes are probably the farthest thing from your mind. However, several tax concerns may need to be addressed to ensure that taxes are kept... Read More

The current estate tax exemption amount ($13.61 million in 2024) has led many people to feel they no longer need to be concerned about federal estate tax. Before 2011, a... Read More

Buckle up, America: Major tax changes are on the horizon. The reason has to do with tax law and the upcoming elections. Our current situation The Tax Cuts and Jobs... Read More

Employees, self-employed individuals and employers all pay Social Security tax, and the amounts can get bigger every year. And yet, many people don’t fully understand the Social Security tax they... Read More

From the minute they open their doors, business owners are urged to keep a close eye on cash flow. And for good reason — even companies with booming sales can... Read More

Business owners are rightly urged to develop succession plans so their companies will pass on to the next generation, or another iteration of ownership, in a manner that best ensures... Read More

There are many rewards for taking care of an elderly relative. They may include feeling needed, making a difference in the person’s life and allowing the person to receive quality... Read More

If you donate valuable items to charity and you want to deduct them on your tax return, you may be required to get an appraisal. The IRS requires donors and... Read More

Many people dream of turning a hobby into a regular business. Perhaps you enjoy boating and would like to open a charter fishing business. Or maybe you’d like to turn... Read More

Vacation homes in upscale areas may be worth way more than owners paid for them. That’s great, but what about taxes? Here are three scenarios to illustrate the federal income... Read More

Most people are genuinely appreciative of inheritances, and who wouldn’t enjoy some unexpected money? But in some cases, it may turn out to be too good to be true. While... Read More

If you’re buying a new home, you may have thought about keeping your current home and renting it out. In March, average rents for one- and two-bedroom residences were $1,487... Read More

The tax filing deadline for 2023 tax returns is April 15 this year. If you need more time, you can file for an extension until October 15. In either case,... Read More

The April 15 tax filing deadline is right around the corner. However, you might not be ready to file. Sometimes, it’s not possible to gather your tax information by the... Read More

If you have a tax-favored retirement account, including a traditional IRA, you’ll become exposed to the federal income tax required minimum distribution (RMD) rules after reaching a certain age. If... Read More

Are you dreaming of buying a vacation beach home, lakefront cottage or ski chalet? Or perhaps you’re fortunate enough to already own a vacation home. In either case, you may... Read More

Some people mistakenly believe that Social Security benefits are always free from federal income tax. Unfortunately, that’s often not the case. In fact, depending on how much overall income you... Read More

Unemployment has been holding steady recently at 3.7%. But there are still some people losing their jobs — particularly in certain industries including technology and media. If you’re laid off... Read More

With the high cost of college, many parents begin saving with 529 plans when their children are babies. Contributions to these plans aren’t tax deductible, but they grow tax deferred.... Read More

Many small business owners run their companies as leanly as possible. This often means not offering what are considered standard fringe benefits for midsize or larger companies, such as a... Read More

If you’re gathering documents to file your 2023 tax return and you’re concerned that your tax bill may be higher than you’d like, there might still be an opportunity to... Read More

Did you make large gifts to your children, grandchildren or others last year? If so, it’s important to determine if you’re required to file a 2023 gift tax return. In... Read More

When you file your tax return, a tax filing status must be chosen. This status is used to determine your standard deduction, tax rates, eligibility for certain tax breaks and... Read More

Did you donate to charity last year? Acknowledgment letters from the charities you gave to may have already shown up in your mailbox. But if you don’t receive such a... Read More

Although traditional IRAs and Roth IRAs have been around for decades, the rules involved have changed many times. The Secure 2.0 law, which was enacted at the end of 2022,... Read More

No one likes to make a mistake. This is especially true in business, where a wrong decision can cost money, time and resources. According to the results of a recent... Read More

The so-called “kiddie tax” can cause some of a child’s unearned income to be taxed at the parent’s higher marginal federal income tax rates instead of at the usually much... Read More

In the wide, wide world of mergers and acquisitions (M&A), most business buyers conduct thorough due diligence before closing their deals. This usually involves carefully investigating the target company’s financial,... Read More

As each year winds to a close, owners of established businesses can count on having plenty of at least one thing: information. That is, they have another full calendar year... Read More

When you retire, you may think about moving to another state — perhaps because the weather is more temperate or because you want to be closer to family members. Don’t... Read More

Business owners, with the year just about over, you and your leadership team presumably have a pretty good idea of where you want your company to go in 2024. The... Read More

Monetary awards and settlements are often provided for an array of reasons. For example, a person could receive compensatory and punitive damage payments for personal injury, discrimination or harassment. Some... Read More

You may have heard of the “nanny tax.” But if you don’t employ a nanny, you may think it doesn’t apply to you. Check again. Hiring a housekeeper, gardener or... Read More

If you’re facing a serious cash shortfall, one possible solution is to take an early withdrawal from your traditional IRA. That means one before you’ve reached age 59½. For this... Read More

No one needs to remind business owners that the cost of employee health care benefits keeps going up. One way to provide some of these benefits is through an employer-sponsored... Read More

The effects of inflation are all around. You’re probably paying more for gas, food, health care and other expenses than you were last year. Are you wondering how high inflation... Read More

Two tax benefits are available to offset the expenses of adopting a child. In 2022, adoptive parents may be able to claim a credit against their federal tax for up... Read More

The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $160,200 for 2023 (up from $147,000 for 2022). Wages and self-employment income... Read More

Are you feeling generous at year end? Taxpayers can transfer substantial amounts free of gift taxes to their children or other recipients each year through the proper use of the... Read More

Whether you’re considering selling your business or acquiring another one, due diligence is a must. In many mergers and acquisitions (M&A), prospective buyers obtain a quality of earnings (QOE) report... Read More

You and your small business are likely to incur a variety of local transportation costs each year. There are various tax implications for these expenses. First, what is “local transportation?”... Read More

If you have a child or grandchild who’s going to attend college in the future, you’ve probably heard about qualified tuition programs, also known as 529 plans. These plans, named... Read More

Now that fall is officially here, it’s a good time to start taking steps that may lower your tax bill for this year and next. One of the first planning... Read More

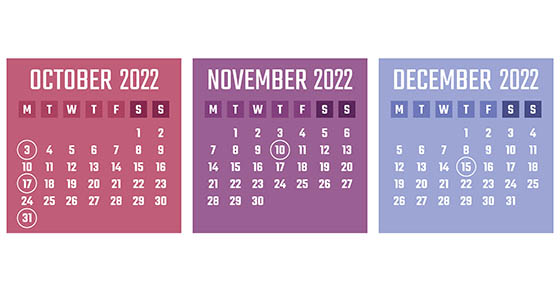

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may... Read More

In its latest report, the National Association of Realtors (NAR) announced that July 2022 existing home sales were down but prices were up nationwide, compared with last year. “The ongoing... Read More

For a company to be truly successful, its ownership needs to attempt the impossible: see into the future. Forecasting key metrics — such as sales demand, receivables, payables and working... Read More

You may have heard that the Inflation Reduction Act (IRA) was signed into law recently. While experts have varying opinions about whether it will reduce inflation in the near future,... Read More

The Inflation Reduction Act (IRA), signed into law by President Biden on August 16, contains many provisions related to climate, energy and taxes. There has been a lot of media... Read More

If you’re a business owner working from home or an entrepreneur with a home-based side gig, you may qualify for valuable home office deductions. But not everyone who works from... Read More

When a married couple files a joint tax return, each spouse is “jointly and severally” liable for the full amount of tax on the couple’s combined income. Therefore, the IRS... Read More

The business entity you choose can affect your taxes, your personal liability and other issues. A limited liability company (LLC) is somewhat of a hybrid entity in that it can... Read More

As you’re aware, certain employers are required to report information related to their employees’ health coverage. Does your business have to comply, and if so, what must be done? Basic... Read More

If you don’t have enough federal tax withheld from your paychecks and other payments, you may have to make estimated tax payments. This is the case if you receive interest,... Read More

When you filed your federal tax return this year, were you surprised to find you owed money? You might want to change your withholding so that this doesn’t happen again... Read More

Business owners often find the greatest obstacle to innovation isn’t the change itself, but employees’ resistance to it. Their hesitation or outright defiance is frequently driven by fear. Some workers... Read More

Sometimes, bigger isn’t better: Your small- or medium-sized business may be eligible for some tax breaks that aren’t available to larger businesses. Here are some examples. QBI deduction For 2018... Read More

Like a slowly gathering storm, inflation has gone from dark clouds on the horizon to a noticeable downpour on both the U.S. and global economies. Is it time for business... Read More

Sales and registrations of electric vehicles (EVs) have increased dramatically in the U.S. in 2022, according to several sources. However, while they’re still a small percentage of the cars on... Read More

Sadly, many businesses have been forced to shut down recently due to the pandemic and the economy. If this is your situation, we can assist you, including taking care of... Read More

Under IRS regulations regarding electronic consents and elections, if a signature must be witnessed by a retirement plan representative or notary public, it must be witnessed “in the physical presence”... Read More

If you’ve recently begun receiving disability income, you may wonder how it’s taxed. The answer is: It depends. The key issue is: Who paid for the benefit? If the income... Read More

Like many businesses, yours has probably jumped aboard the cloud computing bandwagon … or “skywagon” as the case may be. How’s that going? Some business owners pay little to no... Read More

Business owners are aware that the price of gas is historically high, which has made their vehicle costs soar. The average nationwide price of a gallon of unleaded regular gas... Read More

Once a relatively obscure concept, “income in respect of a decedent” (IRD) may create a surprising tax bill for those who inherit certain types of property, such as IRAs or... Read More

Like many people, you may have dreamed of turning a hobby into a regular business. You won’t have any tax headaches if your new business is profitable. But what if... Read More

What are the tax consequences of selling property used in your trade or business? There are many rules that can potentially apply to the sale of business property. Thus, to... Read More

In some cases, homeowners decide to move to new residences, but keep their present homes and rent them out. If you’re thinking of doing this, you’re probably aware of the... Read More

The tax filing deadline for 2021 tax returns is April 18 this year. After your 2021 tax return has been successfully filed with the IRS, there may still be some... Read More

Operating as an S corporation may help reduce federal employment taxes for small businesses in the right circumstances. Although S corporations may provide tax advantages over C corporations, there are... Read More

If you’re an investor in mutual funds or you’re interested in putting some money into them, you’re not alone. According to the Investment Company Institute, a survey found 58.7 million... Read More

Pay equity is both required by law and a sound business practice. However, providing equitable compensation to employees who perform the same or similar jobs, while accounting for differences in... Read More

The clock is ticking down to the April 18 tax filing deadline. Sometimes, it’s not possible to gather your tax information and file by the due date. If you need... Read More

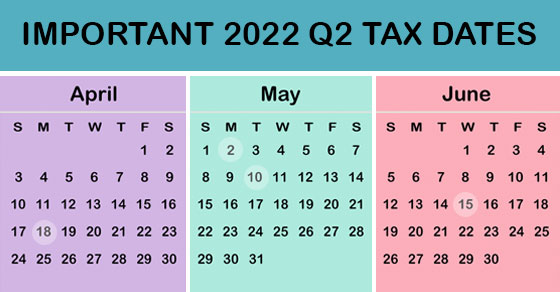

at apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to... Read More

In recent years, more and more businesses have increased efforts to support the well-being of their employees. This means not only providing health care benefits, but also offering other initiatives... Read More

Summer is just around the corner. If you’re fortunate enough to own a vacation home, you may wonder about the tax consequences of renting it out for part of the... Read More

Typically, businesses want to delay recognition of taxable income into future years and accelerate deductions into the current year. But when is it prudent to do the opposite? And why... Read More

Business owners are regularly urged to “see the big picture.” In many cases, this imperative applies to a pricing adjustment or some other strategic planning idea. However, seeing the big... Read More

If your business doesn’t already have a retirement plan, now might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example,... Read More

Although there have been some positive signs for the U.S. economy thus far in 2022, many businesses are still reeling from last year’s “Great Resignation.” This trend of a historic... Read More

Despite the robust job market, there are still some people losing their jobs. If you’re laid off or terminated from employment, taxes are probably the last thing on your mind.... Read More

The credit for increasing research activities, often referred to as the research and development (R&D) credit, is a valuable tax break available to eligible businesses. Claiming the credit involves complex... Read More

Under just about any circumstances, the word “leakage” has negative connotations. And so it follows that this indeed holds true for retirement planning as well. In this context, leakage refers... Read More

Now that 2022 is up and running, business owners can expect to face a few challenges and tough choices as the year rolls along. No matter how busy things get,... Read More

If you’re married, you may wonder whether you should file joint or separate tax returns. The answer depends on your individual tax situation. In general, it depends on which filing... Read More

Do you want to withdraw cash from your closely held corporation at a minimum tax cost? The simplest way is to distribute cash as a dividend. However, a dividend distribution... Read More

If you donated to charity last year, letters from the charities may have appeared in your mailbox recently acknowledging the donations. But what happens if you haven’t received such a... Read More

If you’re in business for yourself as a sole proprietor, or you’re planning to start a business, you need to know about the tax aspects of your venture. Here are... Read More

If you operate a business, or you’re starting a new one, you know you need to keep records of your income and expenses. Specifically, you should carefully record your expenses... Read More

While some businesses have closed since the start of the COVID-19 crisis, many new ventures have launched. Entrepreneurs have cited a number of reasons why they decided to start a... Read More

Companies that sell products or services primarily to other businesses face a tough challenge when it comes to marketing. Your customers are likely well-versed and experienced in what they do,... Read More

Many tax limits that affect businesses are annually indexed for inflation, and a number of them have increased for 2022. Here’s a rundown of those that may be important to... Read More

The IRS announced it is opening the 2021 individual income tax return filing season on January 24. (Business returns are already being accepted.) Even if you typically don’t file until... Read More

For many businesses, technology has changed from something they use to something they do. When a company reaches a point where IT plays a central role in operations and productivity,... Read More

While Congress didn’t pass the Build Back Better Act in 2021, there are still tax changes that may affect your tax situation for this year. That’s because some tax figures... Read More

Business owners, year end is officially here. It may even be over by the time you read this. (If so, Happy New Year!) In any case, the end of one... Read More

After two years of no increases, the optional standard mileage rate used to calculate the deductible cost of operating an automobile for business will be going up in 2022 by... Read More

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may... Read More

The use of a company vehicle is a valuable fringe benefit for owners and employees of small businesses. This perk results in tax deductions for the employer as well as... Read More

Among the biggest long-term concerns of many business owners is succession planning — how to smoothly and safely transfer ownership and control of the company to the next generation. From... Read More

If your business is successful and you do a lot of business travel, you may have considered buying a corporate aircraft. Of course, there are tax and non-tax implications for... Read More

Don’t let the holiday rush keep you from considering some important steps to reduce your 2021 tax liability. You still have time to execute a few strategies. Purchase assets Thinking... Read More

In Notice 2021-61, the IRS recently announced 2022 cost-of-living adjustments to dollar limits and thresholds for qualified retirement plans. Here are some highlights: Elective deferrals. The annual limit on elective... Read More

Every business should prepare an annual budget. Creating a comprehensive, realistic spending plan allows you to identify potential shortages of cash, possible constraints on your capacity to fulfill strategic objectives,... Read More

Do you have a tax-saving flexible spending account (FSA) with your employer to help pay for health or dependent care expenses? As the end of 2021 nears, there are some... Read More

With Thanksgiving just around the corner, the holiday season will soon be here. At this time of year, your business may want to show its gratitude to employees and customers... Read More

As we approach the holidays, many people plan to donate to their favorite charities or give money or assets to their loved ones. Here are the basic tax rules involved... Read More

Are you planning to launch a business or thinking about changing your business entity? If so, you need to determine which entity will work best for you — a C... Read More

Are you considering a move to another state when you retire? Perhaps you want to relocate to an area where your loved ones live or where the weather is more... Read More

With the increasing cost of employee health care benefits, your business may be interested in providing some of these benefits through an employer-sponsored Health Savings Account (HSA). For eligible individuals,... Read More

Employers offer 401(k) plans for many reasons, including to attract and retain talent. These plans help an employee accumulate a retirement nest egg on a tax-advantaged basis. If you’re thinking... Read More

The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $147,000 for 2022 (up from $142,800 for 2021). Wages and self-employment income... Read More

Have you heard of the “nanny tax?” Even if you don’t employ a nanny, it may apply to you. Hiring a house cleaner, gardener or other household employee (who isn’t... Read More

When creating or updating your strategic plan, you might be tempted to focus on innovative products or services, new geographic locations, or technological upgrades. But, what about your customers? Particularly... Read More

If your business is depreciating over a 30-year period the entire cost of constructing the building that houses your operation, you should consider a cost segregation study. It might allow... Read More

If you’re fortunate enough to own a vacation home, you may want to rent it out for part of the year. What are the tax consequences? The tax treatment can... Read More

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may... Read More

Are employees at your business traveling again after months of virtual meetings? In Notice 2021-52, the IRS announced the fiscal 2022 “per diem” rates that became effective October 1, 2021. Taxpayers... Read More

If you own a valuable piece of art, or other property, you may wonder how much of a tax deduction you could get by donating it to charity. The answer... Read More

In today’s data-driven world, business owners are constantly urged to track everything. And for good reason — having accurate, timely information displayed in an easy-to-understand format can allow you to... Read More

Low interest rates and other factors have caused global merger and acquisition (M&A) activity to reach new highs in 2021, according to Refinitiv, a provider of financial data. It reports... Read More

For many small businesses, the grand reopening is still on hold. The rapid spread of the Delta variant of COVID-19 has mired a variety of companies in diminished revenue and... Read More

Given the escalating cost of health care, there may be a more cost-effective way to pay for it. For eligible individuals, a Health Savings Account (HSA) offers a tax-favorable way... Read More

The U.S. economy has been nothing short of a roller-coaster ride for the past year and a half. Some industries have had to overcome seemingly insurmountable challenges, while others have... Read More

Many homeowners across the country have seen their home values increase recently. According to the National Association of Realtors, the median price of homes sold in July of 2021 rose... Read More

A business may be able to claim a federal income tax deduction for a theft loss. But does embezzlement count as theft? In most cases it does but you’ll have... Read More

As we approach the holidays and the end of the year, many people may want to make gifts of cash or stock to their loved ones. By properly using the... Read More

For many small to midsize businesses, spending money on marketing calls for a leap of faith that the benefits will outweigh the costs. Much of the planning process tends to... Read More

In recent weeks, some Americans have been victimized by hurricanes, severe storms, flooding, wildfires and other disasters. No matter where you live, unexpected disasters may cause damage to your home... Read More

In order to prepare for a business audit, an IRS examiner generally does research about the specific industry and issues on the taxpayer’s return. Examiners may use IRS “Audit Techniques... Read More

Business owners are regularly urged to create and update their succession plans. And rightfully so — in the event of an ownership change, a solid succession plan can help prevent... Read More

Employer-provided life insurance is a coveted fringe benefit. However, if group term life insurance is part of your benefit package, and the coverage is higher than $50,000, there may be... Read More

If you’re a business owner and you’re getting a divorce, tax issues can complicate matters. Your business ownership interest is one of your biggest personal assets and in many cases,... Read More

There may be a tax-advantaged way for people to save for the needs of family members with disabilities — without having them lose eligibility for government benefits to which they’re... Read More

What if you decide to, or are asked to, guarantee a loan to your corporation? Before agreeing to act as a guarantor, endorser or indemnitor of a debt obligation of... Read More

If your child is fortunate enough to be awarded a scholarship, you may wonder about the tax implications. Fortunately, scholarships (and fellowships) are generally tax free for students at elementary,... Read More

Many businesses are spending more time and resources on supporting the well-being of their employees. This includes recognizing and addressing issues related to diversity, equity and inclusion (DEI). A thoughtfully... Read More

If you have a parent entering a nursing home, you may not be thinking about taxes. But there are a number of possible tax implications. Here are five. 1. Long-term... Read More

Perhaps you operate your small business as a sole proprietorship and want to form a limited liability company (LLC) to protect your assets. Or maybe you are launching a new... Read More

Most business owners would likely agree that strategic planning is important. Yet many companies rarely engage in active measures to gather and discuss strategy. Sometimes strategic planning is tacked on... Read More

More than 43 million student borrowers are in debt with an average of $39,351 each, according to the research group EducationData.org. If you have student loan debt, you may wonder... Read More

If you’re planning your estate, or you’ve recently inherited assets, you may be unsure of the “cost” (or “basis”) for tax purposes. The current rules Under the current fair market... Read More

Are you wondering whether alternative energy technologies can help you manage energy costs in your business? If so, there’s a valuable federal income tax benefit (the business energy credit) that... Read More

No matter the size or shape of a business, one really can’t overstate the importance of sound accounts receivable policies and procedures. Without a strong and steady inflow of cash,... Read More

No matter the size or shape of a business, one really can’t overstate the importance of sound accounts receivable policies and procedures. Without a strong and steady inflow of cash,... Read More

Do you have significant investment-related expenses, including the cost of subscriptions to financial services, home office expenses and clerical costs? Under current tax law, these expenses aren’t deductible through 2025... Read More

The IRS just released its audit statistics for the 2020 fiscal year and fewer taxpayers had their returns examined as compared with prior years. But even though a small percentage... Read More

The IRS just released its audit statistics for the 2020 fiscal year and fewer taxpayers had their returns examined as compared with prior years. But even though a small percentage... Read More

Do you have significant investment-related expenses, including the cost of subscriptions to financial services, home office expenses and clerical costs? Under current tax law, these expenses aren’t deductible through 2025... Read More

Are you wondering whether alternative energy technologies can help you manage energy costs in your business? If so, there’s a valuable federal income tax benefit (the business energy credit) that... Read More

Are you eligible to take the deduction for qualified business income (QBI)? Here are 10 facts about this valuable tax break, referred to as the pass-through deduction, QBI deduction or... Read More

The Employee Retention Tax Credit (ERTC) is a valuable tax break that was extended and modified by the American Rescue Plan Act (ARPA), enacted in March of 2021. Here’s a... Read More

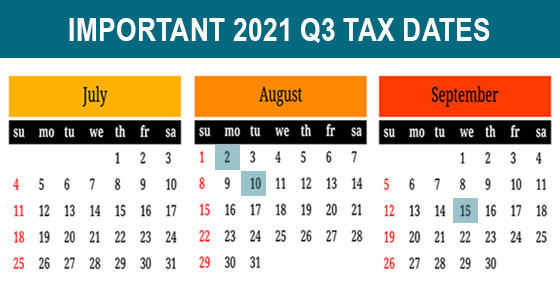

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may... Read More

If you’re getting ready to retire, you’ll soon experience changes in your lifestyle and income sources that may have numerous tax implications. Here’s a brief rundown of four tax and... Read More

For many business owners, putting together a succession plan may seem like an overwhelming task. It might even seem unnecessary for those who are relatively young and have no intention... Read More

High-income taxpayers face a 3.8% net investment income tax (NIIT) that’s imposed in addition to regular income tax. Fortunately, there are some steps you may be able to take to... Read More

If you’re a business owner and you hire your children this summer, you can obtain tax breaks and other nontax benefits. The kids can gain on-the-job experience, spend time with... Read More

Even after your 2020 tax return has been successfully filed with the IRS, you may still have some questions about the return. Here are brief answers to three questions that... Read More

For businesses, so much has changed over the past year or so. The COVID-19 pandemic hit suddenly and companies were forced to react quickly — sending many employees home to... Read More

If your business is organized as a sole proprietorship or as a wholly owned limited liability company (LLC), you’re subject to both income tax and self-employment tax. There may be... Read More

Before the COVID-19 pandemic hit, the number of people engaged in the “gig” or sharing economy had been growing, according to several reports. And reductions in working hours during the... Read More

Many businesses provide education fringe benefits so their employees can improve their skills and gain additional knowledge. An employee can receive, on a tax-free basis, up to $5,250 each year... Read More

The COVID-19 pandemic has affected various industries in very different ways. Widespread lockdowns and discouraged movement have led to increased profitability for some manufacturers and many big-box retailers. The restaurant... Read More

In a society increasingly conscious of well-being, with the costs of health care benefits remaining high, many businesses have established or are considering employee wellness programs. The Centers for Disease... Read More

“Tax day” is just around the corner. This year, the deadline for filing 2020 individual tax returns is Monday, May 17, 2021. The IRS postponed the usual April 15 due... Read More

The May 17 deadline for filing your 2020 individual tax return is coming up soon. It’s important to file and pay your tax return on time to avoid penalties imposed... Read More

With so many employees working remotely these days, engaging in competitive intelligence has never been easier. The Internet as a whole, and social media specifically, create a data-rich environment in... Read More

In recent months, there have been a number of tax changes that may affect your individual tax bill. Many of these changes were enacted to help mitigate the financial damage... Read More

The premium tax credit (PTC) is a refundable credit that helps individuals and families pay for insurance obtained from a Health Insurance Marketplace (commonly known as an “Exchange”). A provision... Read More

The housing market in many parts of the country is strong this spring. If you’re buying or selling a home, you should know how to determine your “basis.” How it... Read More

Are you thinking about setting up a retirement plan for yourself and your employees, but you’re worried about the financial commitment and administrative burdens involved in providing a traditional pension... Read More

If you were to ask your IT staff about how tech support for remote employees is going, they might say something along the lines of, “Fantastic! Never better!” However, if... Read More

When you file your tax return, you must check one of the following filing statuses: Single, married filing jointly, married filing separately, head of household or qualifying widow(er). Who qualifies... Read More

If you have a life insurance policy, you may want to ensure that the benefits your family will receive after your death won’t be included in your estate. That way,... Read More

The American Rescue Plan Act (ARPA), signed into law in early March, aims at offering widespread financial relief to individuals and employers adversely affected by the COVID-19 pandemic. The law... Read More

Are you thinking about launching a business with some partners and wondering what type of entity to form? An S corporation may be the most suitable form of business for... Read More

The new American Rescue Plan Act (ARPA) provides eligible families with an enhanced child and dependent care credit for 2021. This is the credit available for expenses a taxpayer pays... Read More

The American Rescue Plan Act, signed into law on March 11, provides a variety of tax and financial relief to help mitigate the effects of the COVID-19 pandemic. Among the... Read More

Many businesses have retained employees during the COVID-19 pandemic and enjoyed tax relief with the help of the employee retention credit (ERC). The recent signing of the American Rescue Plan... Read More

The U.S. economy is still a far cry from where it was before the COVID-19 pandemic hit about a year ago. Nonetheless, as vaccination efforts continue to ramp up, many... Read More

April 15 is not only the deadline for filing your 2020 tax return, it’s also the deadline for the first quarterly estimated tax payment for 2021, if you’re required to... Read More

While many businesses have been forced to close due to the COVID-19 pandemic, some entrepreneurs have started new small businesses. Many of these people start out operating as sole proprietors.... Read More

When the Small Business Administration (SBA) launched the Paycheck Protection Program (PPP) last year, the program’s stated objective was “to provide a direct incentive for small businesses to keep their... Read More

If you’re approaching retirement, you probably want to ensure the money you’ve saved in retirement plans lasts as long as possible. If so, be aware that a law was recently... Read More

If you’re getting ready to file your 2020 tax return, and your tax bill is higher than you’d like, there might still be an opportunity to lower it. If you... Read More

During the COVID-19 pandemic, many people are working from home. If you’re self-employed and run your business from your home or perform certain functions there, you might be able to... Read More

The events of the past year have taught business owners many important lessons. One of them is that, when a crisis hits, customers turn on their computers and look to... Read More

If you’re like many Americans, letters from your favorite charities may be appearing in your mailbox acknowledging your 2020 donations. But what happens if you haven’t received such a letter... Read More

Merger and acquisition activity in many industries slowed during 2020 due to COVID-19. But analysts expect it to improve in 2021 as the country comes out of the pandemic. If... Read More

Using a strengths, weaknesses, opportunities and threats (SWOT) analysis to frame an important business decision is a long-standing recommended practice. But don’t overlook other, broader uses that could serve your... Read More

A number of tax-related limits that affect businesses are annually indexed for inflation, and many have increased for 2021. Some stayed the same due to low inflation. And the deduction... Read More

Although electric vehicles (or EVs) are a small percentage of the cars on the road today, they’re increasing in popularity all the time. And if you buy one, you may... Read More

Over the past year, the importance of leadership at every level of a business has been emphasized. When a crisis such as a pandemic hits, it creates a sort of... Read More

Many business owners generate financial statements, at least in part, because lenders and other stakeholders demand it. You’re likely also aware of how insightful properly prepared financial statements can be... Read More

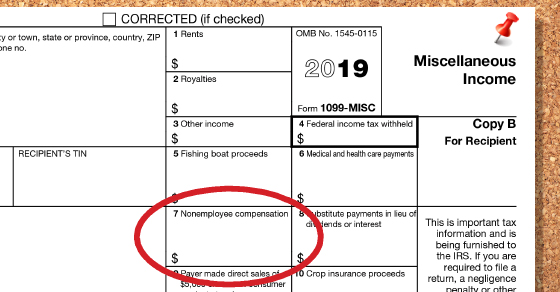

There’s a new IRS form for business taxpayers that pay or receive certain types of nonemployee compensation and it must be furnished to most recipients by February 1, 2021. After sending... Read More

If you have a traditional IRA or tax-deferred retirement plan account, you probably know that you must take required minimum distributions (RMDs) when you reach a certain age — or... Read More

Governor Kim Reynolds recently announced the allocation of approximately $100 million of Federal CARES Act relief funds to several different agricultural programs. You may be eligible to receive funding from... Read More

The extended federal income tax deadline is coming up fast. As you know, the IRS postponed until July 15 the payment and filing deadlines that otherwise would have fallen on... Read More

The IRS and the U.S. Treasury had disbursed 160.4 million Economic Impact Payments (EIPs) as of May 31, 2020, according to a new report. These are the payments being sent... Read More

As you may have heard, the Coronavirus Aid, Relief and Economic Security (CARES) Act allows “qualified” people to take certain “coronavirus-related distributions” from their retirement plans without paying tax. So... Read More

Just about every business owner’s strategic plans for 2020 look far different now than they did heading into the year. The COVID-19 pandemic has changed the economy in profound ways,... Read More

As you may recall, the Small Business Administration (SBA) launched the Paycheck Protection Program (PPP) back in April to help companies reeling from the economic impact of the COVID-19 pandemic.... Read More

The recent riots around the country have resulted in many storefronts, office buildings and business properties being destroyed. In the case of stores or other businesses with inventory, some of... Read More

It’s often difficult for married couples to save as much as they need for retirement when one spouse doesn’t work outside the home — perhaps so that spouse can take... Read More

Economists will look back on 2020 as a year with a distinct before and after. In early March, most companies’ sales projections looked a certain way. Just a few weeks... Read More

The IRS recently released the 2021 inflation-adjusted amounts for Health Savings Accounts (HSAs). HSA basics An HSA is a trust created or organized exclusively for the purpose of paying the... Read More

The economic impact of the novel coronavirus (COVID-19) is unprecedented and many taxpayers with student loans have been hard hit. The Coronavirus Aid, Relief and Economic Security (CARES) Act contains... Read More

Social media for business: Your time has come. That’s not to say it wasn’t important before but, during the novel coronavirus (COVID-19) pandemic, connecting with customers and prospects via a... Read More

Nearly everyone has heard about the Economic Impact Payments (EIPs) that the federal government is sending to help mitigate the effects of the coronavirus (COVID-19) pandemic. The IRS reports that... Read More

The IRS has issued guidance clarifying that certain deductions aren’t allowed if a business has received a Paycheck Protection Program (PPP) loan. Specifically, an expense isn’t deductible if both: The... Read More

Many small businesses continue to struggle in the wake of the coronavirus (COVID-19) pandemic. Some have already closed their doors and are liquidating assets. Others, however, may have a relatively... Read More

Do you want to save more for retirement on a tax-favored basis? If so, and if you qualify, you can make a deductible traditional IRA contribution for the 2019 tax... Read More

The Coronavirus Aid, Relief, and Economic Security (CARES) Act eliminates some of the tax-revenue-generating provisions included in a previous tax law. Here’s a look at how the rules for claiming... Read More

The IRS recently issued Notice 2020-23, expanding on previously issued guidance extending certain tax filing and payment deadlines in response to the novel coronavirus (COVID-19) crisis. This guidance applies to... Read More

In many industries, offering a 401(k) plan is a competitive necessity. If you don’t offer one and a competitor does, it could mean the difference in a job candidate’s decision... Read More

In the midst of the coronavirus (COVID-19) pandemic, Americans are focusing on their health and financial well-being. To help with the impact facing many people, the government has provided a... Read More

To stem the tide of joblessness caused by the coronavirus (COVID-19) outbreak, the Small Business Administration (SBA) has officially launched the Paycheck Protection Program (PPP). The program’s stated objective is... Read More

As we all try to keep ourselves, our loved ones, and our communities safe from the coronavirus (COVID-19) pandemic, you may be wondering about some of the recent tax changes... Read More

If you have a life insurance policy, you probably want to make sure that the life insurance benefits your family will receive after your death won’t be included in your... Read More

A new law signed by President Trump on March 27 provides a variety of tax and financial relief measures to help Americans during the coronavirus (COVID-19) pandemic. This article explains... Read More

With the empty bottles of bubbly placed safely in the recycling bin and the confetti swept off the floor, it’s time to get back to the grind. The beginning of... Read More

If you save for retirement with an IRA or other plan, you’ll be interested to know that Congress recently passed a law that makes significant modifications to these accounts. The... Read More

A significant law was recently passed that adds tax breaks and makes changes to employer-provided retirement plans. If your small business has a current plan for employees or if you’re... Read More

If your company comes up over budget year after year, you may want to consider cost management. This is a formalized, systematic review of operations and resources with the stated... Read More

Technology has made it easier to work from home, so lots of people now commute each morning to an office down the hall. However, just because you have a home... Read More

The end of one year and the beginning of the next is a great opportunity for reflection and planning. You have 12 months to look back on and another 12... Read More

As part of a year-end budget bill, Congress just passed a package of tax provisions that will provide savings for some taxpayers. The White House has announced that President Trump... Read More

In its 2018 decision in South Dakota v. Wayfair, the U.S. Supreme Court upheld South Dakota’s “economic nexus” statute, expanding the power of states to collect sales tax from remote... Read More

If your marketing budget is limited, there may be ways to make that money go further. Smart strategies abound for small to midsize businesses. Let’s look at a few ideas... Read More

The number of people engaged in the “gig” or sharing economy has grown in recent years, according to a 2019 IRS report. And there are tax consequences for the people... Read More

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2020. Keep in mind that this list isn’t all-inclusive, so there may... Read More

Business owners are urged to create succession plans for the good of their families and their employees. But there’s someone else who holds a key interest in the longevity of... Read More

If you’re starting to fret about your 2019 tax bill, there’s good news — you may still have time to reduce your liability. Three strategies are available that may help... Read More

Don’t let the holiday rush keep you from taking some important steps to reduce your 2019 tax liability. You still have time to execute a few strategies, including: Buying... Read More

As we all know, medical services and prescription drugs are expensive. You may be able to deduct some of your expenses on your tax return but the rules make it... Read More

At this time of year, many business owners ask if there’s anything they can do to save tax for the year. Under current tax law, there are two valuable depreciation-related... Read More

At many companies, a wide gap exists between the budgeting process and risk management. Failing to consider major threats could leave you vulnerable to high-impact hits to your budget if... Read More

For tax purposes, December 31 means more than New Year’s Eve celebrations. It affects the filing status box that will be checked on your tax return for the year. When... Read More

If your company faces the need to “remediate” or clean up environmental contamination, the money you spend can be deductible on your tax return as ordinary and necessary business expenses.... Read More

With Thanksgiving behind us, the holiday season is in full swing. At this time of year, your business may want to show its gratitude to employees and customers by giving... Read More

You can reduce taxes and save for retirement by contributing to a tax-advantaged retirement plan. If your employer offers a 401(k) or Roth 401(k) plan, contributing to it is a... Read More

A month after the new year begins, your business may be required to comply with rules to report amounts paid to independent contractors, vendors and others. You may have to... Read More

Cloud computing — storing data and accessing apps via the Internet — has been widely adopted by businesses across industry and size. Like many technological advances, though, new derivatives continue... Read More

There’s a tax-advantaged way for people to save for the needs of family members with disabilities — without having them lose eligibility for government benefits to which they’re entitled. It... Read More

One of the most laborious tasks for small businesses is managing payroll. But it’s critical that you not only withhold the right amount of taxes from employees’ paychecks but also... Read More

In many industries, market conditions move fast. Businesses that don’t have their ears to the ground can quickly get left behind. That’s just one reason why some of today’s savviest... Read More

Are you charitably minded and have a significant amount of money in an IRA? If you’re age 70½ or older, and don’t need the money from required minimum distributions, you... Read More

The right entity choice can make a difference in the tax bill you owe for your business. Although S corporations can provide substantial tax advantages over C corporations in some... Read More

Every new company should launch with a business plan and keep it updated. Generally, such a plan will comprise six sections: executive summary, business description, industry and marketing analysis, management... Read More

If you’re planning to sell assets at a loss to offset gains that have been realized during the year, it’s important to be aware of the “wash sale” rule. ... Read More

Is your business depreciating over a 30-year period the entire cost of constructing the building that houses your operation? If so, you should consider a cost segregation study. It may... Read More

Merging with, or acquiring, another company is one of the best ways to grow rapidly. You might be able to significantly boost revenue, literally overnight, by acquiring another business. In... Read More

There are several ways to save for your child’s or grandchild’s education, including with a Coverdell Education Savings Account (ESA). Although for federal tax purposes there’s no upfront deduction for... Read More

Given the escalating cost of employee health care benefits, your business may be interested in providing some of these benefits through an employer-sponsored Health Savings Account (HSA). For eligible individuals,... Read More

“Love and marriage,” goes the old song: “…You can’t have one without the other.” This also holds true for sales and marketing. Even the best of sales staffs will struggle... Read More

“Thousands of people have lost millions of dollars and their personal information to tax scams,” according to the IRS. Criminals can contact victims through regular mail, telephone calls and email... Read More

As an employer, you must pay federal unemployment (FUTA) tax on amounts up to $7,000 paid to each employee as wages during the calendar year. The rate of tax imposed... Read More

You’d be hard pressed to find a business today that doesn’t have laptop computers listed among its assets. Large companies have hundreds of them; midsize ones issue them to managers... Read More

As we head toward the gift-giving season, you may be considering giving gifts of cash or securities to your loved ones. Taxpayers can transfer substantial amounts free of gift taxes... Read More

Many business owners ask: How can I avoid an IRS audit? The good news is that the odds against being audited are in your favor. In fiscal year 2018, the... Read More

Extending credit to business customers can be an effective way to build goodwill and nurture long-term buyers. But if you extend customer credit, it also brings sizable financial risk to... Read More

Autumn brings falling leaves and … the gridiron. Football teams — from high school to pro — are trying to put as many wins on the board as possible to... Read More

You may have Series EE savings bonds that were bought many years ago. Perhaps you store them in a file cabinet or safe deposit box and rarely think about them.... Read More

These days, most businesses need a website to remain competitive. It’s an easy decision to set one up and maintain it. But determining the proper tax treatment for the costs... Read More

We all know the cost of college is expensive. The latest figures from the College Board show that the average annual cost of tuition and fees was $10,230 for in-state... Read More

2019 Q4 tax calendar: Key deadlines for businesses and other employers Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2019.... Read More

Do you want to withdraw cash from your closely held corporation at a low tax cost? The easiest way is to distribute cash as a dividend. However, a dividend distribution... Read More

In addition to already difficult personal issues, divorce can affect both parties’ taxes. To ensure that taxes are kept to a minimum and that important tax-related decisions are made properly,... Read More

Time flies when you’re having fun — and running a business. Although it’s probably too early to start chilling a bottle of bubbly for New Year’s Eve, it’s certainly not... Read More

We are pleased to announce the admittance of Matthew J. Klostermann, CPA, as a shareholder with Gosling & Company, P.C. Matt has been providing accounting and tax services in... Read More

The tax implications of being a winner If you’re lucky enough to be a winner at gambling or the lottery, congratulations! After you celebrate, be ready to deal with the... Read More

Is it time to hire a CFO or controller? Many business owners reach a point where managing the financial side of the enterprise becomes overwhelming. Usually, this is a good... Read More

Taking a long-term approach to certain insurance documentation After insurance policies expire, many businesses just throw away the paper copies and delete the digital files. But you may need to... Read More

The “kiddie tax” hurts families more than ever Years ago, Congress enacted the “kiddie tax” rules to prevent parents and grandparents in high tax brackets from shifting income (especially from... Read More

Take a closer look at home office deductions Working from home has its perks. Not only can you skip the commute, but you also might be eligible to deduct home... Read More

Run your strategic-planning meetings like they really matter Many businesses struggle to turn abstract strategic-planning ideas into concrete, actionable plans. One reason why is simple: ineffective meetings. The ideas are... Read More

Businesses can utilize the same information IRS auditors use to examine tax returns The IRS uses Audit Techniques Guides (ATGs) to help IRS examiners get ready for audits. Your business... Read More

The “nanny tax” must be paid for more than just nannies You may have heard of the “nanny tax.” But even if you don’t employ a nanny, it may apply... Read More

The 1-2-3 of B2B marketing Does your business market its products or services to other companies? Or might it start doing so in the future? If so, it’s critical to... Read More

Summer: A good time to review your investments You may have heard about a proposal in Washington to cut the taxes paid on investments by indexing capital gains to inflation.... Read More

It’s a good time to buy business equipment and other depreciable property There’s good news about the Section 179 depreciation deduction for business property. The election has long provided a... Read More

Is your accounting software living up to the hype? Accounting software typically sells itself as much more than simple spreadsheet or ledger. The products tend to pride themselves on being... Read More

Volunteering for charity: Do you get a tax break? If you’re a volunteer who works for charity, you may be entitled to some tax breaks if you itemize deductions on... Read More

M&A transactions: Avoid surprises from the IRS If you’re considering buying or selling a business — or you’re in the process of a merger or acquisition — it’s important that... Read More

Odd word, cool concept: Gamification for businesses “Gamification.” It’s perhaps an odd word, but it’s a cool concept that’s become popular among many types of businesses. In its most general... Read More

Bartering: A taxable transaction even if your business exchanges no cash Small businesses may find it beneficial to barter for goods and services instead of paying cash for them. If... Read More

You may have to pay tax on Social Security benefits During your working days, you pay Social Security tax in the form of withholding from your salary or self-employment tax.... Read More

Grading the performance of your company’s retirement plan Imagine giving your company’s retirement plan a report card. Would it earn straight A’s in preparing your participants for their golden years?... Read More

If your kids are off to day camp, you may be eligible for a tax break Now that most schools are out for the summer, you might be sending your... Read More

Which entity is most suitable for your new or existing business? The Tax Cuts and Jobs Act (TCJA) has changed the landscape for business taxpayers. That’s because the law introduced... Read More

Put a number on your midyear performance with the right KPIs We’ve reached the middle of the calendar year. So how are things going for your business? Conversationally you might... Read More

2019 Q3 tax calendar: Key deadlines for businesses and other employers Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2019.... Read More

Is an HSA right for you? To help defray health care costs, many people now contribute to, or are thinking about setting up, Health Savings Accounts (HSAs). With these accounts,... Read More

Hiring this summer? You may qualify for a valuable tax credit Is your business hiring this summer? If the employees come from certain “targeted groups,” you may be eligible for... Read More

Could you unearth hidden profits in your company? Can your business become more profitable without venturing out of its comfort zone? Of course! However, adding new products or services may... Read More

Donating your vehicle to charity may not be a taxwise decision You’ve probably seen or heard ads urging you to donate your car to charity. “Make a difference and receive... Read More

Your succession plan may benefit from a separation of business and real estate Like most businesses, yours probably has a variety of physical assets, such as production equipment, office furnishings... Read More

Thinking about moving to another state in retirement? Don’t forget about taxes When you retire, you may consider moving to another state — say, for the weather or to be... Read More

Employers: Be aware (or beware) of a harsh payroll tax penalty If federal income tax and employment taxes (including Social Security) are withheld from employees’ paychecks and not handed over... Read More

Targeting and converting your company’s sales prospects Companies tend to spend considerable time and resources training and upskilling their sales staff on how to handle existing customers. And this is,... Read More

The chances of IRS audit are down but you should still be prepared The IRS just released its audit statistics for the 2018 fiscal year, and fewer taxpayers had their... Read More

Tax-smart domestic travel: Combining business with pleasure Summer is just around the corner, so you might be thinking about getting some vacation time. If you’re self-employed or a business owner,... Read More

Build long-term relationships with CRM software Few businesses today can afford to let potential buyers slip through the cracks. Customer relationship management (CRM) software can help you build long-term relationships... Read More

It’s a good time to check your withholding and make changes, if necessary Due to the massive changes in the Tax Cuts and Jobs Act (TCJA), the 2019 filing season... Read More

Hire your children this summer: Everyone wins If you’re a business owner and you hire your children (or grandchildren) this summer, you can obtain tax breaks and other nontax benefits.... Read More

The simple truth about annual performance reviews There are many ways for employers to conduct annual performance reviews. So many, in fact, that owners of small to midsize businesses may... Read More

Selling your home? Consider these tax implications Spring and summer are the optimum seasons for selling a home. And interest rates are currently attractive, so buyers may be out in... Read More

Consider a Roth 401(k) plan — and make sure employees use it Roth 401(k) accounts have been around for 13 years now. Studies show that more employers are offering them... Read More

Buy vs. lease: Business equipment edition Life presents us with many choices: paper or plastic, chocolate or vanilla, regular or decaf. For businesses, a common conundrum is buy or lease.... Read More

What type of expenses can’t be written off by your business? If you read the Internal Revenue Code (and you probably don’t want to!), you may be surprised to find... Read More

Check on your refund — and find out why the IRS might not send it It’s that time of year when many people who filed their tax returns in April... Read More

Should your health care plan be more future-focused? The pace of health care cost inflation has remained moderate over the past year or so, and employers are trying to keep... Read More

Plug in tax savings for electric vehicles While the number of plug-in electric vehicles (EVs) is still small compared with other cars on the road, it’s growing — especially in... Read More

Prepare for the worst with a business turnaround strategy Many businesses have a life cycle that, as life cycles tend to do, concludes with a period of decline and failure.... Read More

Casualty loss deductions: You can claim one only for a federally declared disaster Unforeseen disasters happen all the time and they may cause damage to your home or personal property.... Read More

How entrepreneurs must treat expenses on their tax returns Have you recently started a new business? Or are you contemplating starting one? Launching a new venture is a hectic, exciting... Read More

Three questions you may have after you file your return Once your 2018 tax return has been successfully filed with the IRS, you may still have some questions. Here are... Read More

Responding to the nightmare of a data breach It’s every business owner’s nightmare. Should hackers gain access to your customers’ or employees’ sensitive data, the very reputation of your company... Read More

Divorcing business owners need to pay attention to tax implications If you’re getting a divorce, you know it’s a highly stressful time. But if you’re a business owner, tax issues... Read More

Understanding how taxes factor into an M&A transaction Merger and acquisition activity has been brisk in recent years. If your business is considering merging with or acquiring another business, it’s... Read More

Be vigilant about your business credit score As an individual, you’ve no doubt been urged to regularly check your credit score. Most people nowadays know that, with a subpar personal... Read More

Still working after age 70½? You may not have to begin 401(k) withdrawals If you participate in a qualified retirement plan, such as a 401(k), you must generally begin taking... Read More

2019 Q2 tax calendar: Key deadlines for businesses and other employers Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter... Read More

An implementation plan is key to making strategic goals a reality In the broadest sense, strategic planning comprises two primary tasks: establishing goals and achieving them. Many business owners would... Read More

Stretch your college student’s spending money with the dependent tax credit If you’re the parent of a child who is age 17 to 23, and you pay all (or most)... Read More

Careful tax planning required for incentive stock options Incentive stock options (ISOs) are a popular form of compensation for executives and other employees of corporations. They allow you to buy... Read More

Are your employees ignoring their 401(k)s? For many businesses, offering employees a 401(k) plan is no longer an option — it’s a competitive necessity. But employees often grow so accustomed... Read More

Could your business benefit from the tax credit for family and medical leave? The Tax Cuts and Jobs Act created a new federal tax credit for employers that provide qualified... Read More

5 ways to give your sales staff the support they really need “I could sell water to a whale.” Indeed, most salespeople possess an abundance of confidence. One could say... Read More

The 2018 gift tax return deadline is almost here Did you make large gifts to your children, grandchildren or other heirs last year? If so, it’s important to determine whether... Read More

There’s still time for small business owners to set up a SEP retirement plan for last year If you own a business and don’t have a tax-advantaged retirement plan, it’s... Read More

Using knowledge management to develop your succession plan As the old saying goes, “Knowledge is power.” This certainly rings true in business, as those who best understand their industries and... Read More

Vehicle-expense deduction ins and outs for individual taxpayers It’s not just businesses that can deduct vehicle-related expenses. Individuals also can deduct them in certain circumstances. Unfortunately, the Tax Cuts and... Read More

Will leasing equipment or buying it be more tax efficient for your business? Recent changes to federal tax law and accounting rules could affect whether you decide to lease or... Read More

Beware the Ides of March — if you own a pass-through entity Shakespeare’s words don’t apply just to Julius Caesar; they also apply to calendar-year partnerships, S corporations and limited... Read More

Don’t let scope creep ruin your next IT project Today’s business technology is both powerful and restive. No matter how “feature rich” a software solution or hardware asset may be,... Read More

The home office deduction: Actual expenses vs. the simplified method If you run your business from your home or perform certain functions at home that are related to your business,... Read More

Some of your deductions may be smaller (or nonexistent) when you file your 2018 tax return While the Tax Cuts and Jobs Act (TCJA) reduces most income tax rates and... Read More

Best practices when filing a business interruption claim Many companies, especially those that operate in areas prone to natural disasters, should consider business interruption insurance. Unlike a commercial property policy,... Read More

3 big TCJA changes affecting 2018 individual tax returns and beyond When you file your 2018 income tax return, you’ll likely find that some big tax law changes affect you... Read More

When are LLC members subject to self-employment tax? Limited liability company (LLC) members commonly claim that their distributive shares of LLC income — after deducting compensation for services in the... Read More

Why you shouldn’t wait to file your 2018 income tax return The IRS opened the 2018 income tax return filing season on January 28. Even if you typically don’t file... Read More

Fundamental tax truths for C corporations The flat 21% federal income tax rate for C corporations under the Tax Cuts and Jobs Act (TCJA) has been great news for these... Read More

Refine your strategic plan with SWOT With the year underway, your business probably has a strategic plan in place for the months ahead. Or maybe you’ve created a general outline... Read More

Investment interest expense is still deductible, but that doesn’t necessarily mean you’ll benefit As you likely know by now, the Tax Cuts and Jobs Act (TCJA) reduced or eliminated many... Read More

Depreciation-related breaks on business real estate: What you need to know when you file your 2018 return Commercial buildings and improvements generally are depreciated over 39 years, which essentially means... Read More

Is your business stuck in the mud with its marketing plan? A good marketing plan should be like a network of well-paved, clearly marked roads shooting out into the world... Read More

Many tax-related limits affecting businesses increase for 2019 A variety of tax-related limits affecting businesses are annually indexed for inflation, and many have gone up for 2019. Here’s a look... Read More

There’s still time to get substantiation for 2018 donations If you’re like many Americans, letters from your favorite charities have been appearing in your mailbox in recent weeks acknowledging your... Read More

Getting wise to the rise of “smart” buildings Nowadays, data drives everything — including the very buildings in which companies operate. If your business is considering upgrading its current facility,... Read More

What will your marginal income tax rate be? While the Tax Cuts and Jobs Act (TCJA) generally reduced individual tax rates for 2018 through 2025, some taxpayers could see their... Read More

Higher mileage rate may mean larger tax deductions for business miles in 2019 This year, the optional standard mileage rate used to calculate the deductible costs of operating an automobile... Read More

4 business functions you could outsource right now One thing in plentiful supply in today’s business world is help. Orbiting every industry are providers, consultancies and independent contractors offering a... Read More

2 major tax law changes for individuals in 2019 While most provisions of the Tax Cuts and Jobs Act (TCJA) went into effect in 2018 and either apply through 2025... Read More

Is there still time to pay 2018 bonuses and deduct them on your 2018 return? There aren’t too many things businesses can do after a year ends to reduce tax... Read More

Technology tools are necessary in the workplace, but businesses struggle to balance their needs for security and functionality against employees’ rights to privacy. At some companies, loose “bring your own... Read More

If you’re adopting a child, or you adopted one this year, there may be significant tax benefits available to offset the expenses. For 2019, adoptive parents may be able to... Read More

Economic damages: Recovering what was lost A business can suffer economic damages arising from a variety of illegal conduct. Common examples include breach of contract, patent infringement and commercial negligence.... Read More

A review of significant TCJA provisions impacting individual taxpayers Now that 2019 has begun, there isn’t too much you can do to reduce your 2018 income tax liability. But it’s... Read More

Taking the hybrid approach to cloud computing For several years now, cloud computing has been touted as the perfect way for companies large and small to meet their software and... Read More

Change management doesn’t have to be scary Business owners are constantly bombarded with terminology and buzzwords. Although you probably feel a need to keep up with the latest trends, you... Read More

Reduce insurance costs by encouraging employee wellness Protecting your company through the purchase of various forms of insurance is a risk-management necessity. But just because you must buy coverage doesn’t... Read More

A strong BYOD policy combines convenience with security It’s easy to understand why more and more businesses are taking a “bring your own device” (BYOD) approach to the smartphones, tablets... Read More

Donate appreciated stock for twice the tax benefits A tried-and-true year end tax strategy is to make charitable donations. As long as you itemize and your gift qualifies, you can... Read More

Could “bunching” medical expenses into 2018 save you tax? Some of your medical expenses may be tax deductible, but only if you itemize deductions and have enough expenses to exceed... Read More

“Company culture” is a buzzword that’s been around for a while, but your culture may never have mattered as much as it does in today’s transparency-driven business arena. Customers, potential... Read More

Consider all the tax consequences before making gifts to loved ones Many people choose to pass assets to the next generation during life, whether to reduce the size of their... Read More

Choosing the right accounting method for tax purposes The Tax Cuts and Jobs Act (TCJA) liberalized the eligibility rules for using the cash method of accounting, making this method —... Read More

Keep an eye out for extenders legislation The pieces of tax legislation garnering the most attention these days are the Tax Cuts and Jobs Act (TCJA) signed into law last... Read More